CLICK HERE to Download Full Episode

Apple’s iPhones will be mass produced in India by Foxconn Technology from this year onwards, marking a shift of the company’s production from China, Bloomberg reported. Terry Gou, the group Chairman of the Taiwanese manufacturing company, said Prime Minister Narendra Modi invited him to India.

Apple has been producing older models of iPhones in Bengaluru for many years, but it will now expand its manufacturing to the newest models. It was reported earlier this month that Foxconn will start trials of producing iPhone X and iPhone 7 in India before launching a full-scale assembly in its factory in Chennai.

“In the future, we will play a very important role in India’s smartphone industry,” Gou said at an event in Taiwan. “We have moved our production lines there.”

India’s smartphone market is the fastest-growing in the world, leaving behind a stagnated China. Due to Chinese competitors like Xiaomi offering advanced features at lower prices, Apple is losing its market share in the country. It hopes to ramp up its sales in India by manufacturing locally which would let it dodge the 20 percent import duties.

It is unclear how Apple’s foray into manufacturing in India will affect its relationship with China, which has been its production hub for years with Foxconn and other partner companies.

There are two assembly sites of Foxconn in Andhra Pradesh and Tamil Nadu, where it also manufactures Xiaomi and Nokia devices. As the US and China engage in a trade battle, it might be helpful for Apple and Foxconn to find a third market to focus on.

Sources told the wire agency that Foxconn’s Indian assembly line, Hon Hai Precision Industry Co, would serve local and export markets before Apple’s new iPhone models in September. Foxconn’s initial investment will be about $300 million to set up, with lined-up investments depending on capacity expansion.

I said yesterday CR7 was the 🐐

But Messi proving yet again he’s just a different breed. With this cheeky chip, 2 goals & 2 assists I’m convinced he’s not from this planet.. 👽 pic.twitter.com/TYSPnYPxOr— – (@MUnitedG) March 13, 2019

#Messi

funny how the Goalkeeper had to bow.. pic.twitter.com/dYwRu2F3jP— crazy black coder ❁ (@Crazyblackcoder) March 13, 2019

#Thingsyoucando while #Facebookdown #Instagramdown – watch Messi pic.twitter.com/QGqdKEoxuY

— Iconic88 (@Iconic88) March 13, 2019

CLICK HERE TO WATCH LIVE

Defending champion India on Wednesday defeated Maldives by 6-0 in the 5th South Asian Football Federation (SAFF) Women’s Championship.

Keeping its unbeaten record India easily defeated Maldives in its first group match in Nepal’s Biratnagar.

Indian girls dominated the first half and took a 5-0 lead. In the second half, India could manage only a single goal. India has remained unbeaten in SAFF championship since the beginning of the tournament in 2010.

It has won all 20 matches so far. Now India will take on Sri Lanka in its second match in Group B on Sunday.

In group A, Bhutan will play against Bangladesh tomorrow.

CLICK HERE TO WATCH LIVE

Krishna Karwa, Research Analyst at Moneycontrol analyses how the Budget announcement in the consumption space affected sentiment

Higher disposable incomes will also augur well for Future Consumer, a leading retailer of FMCG products, The stock is 5 percent up, in tandem with the upmove seen in FMCG stocks

The Budget fine print shows financial support of Rs 384 crore has been provided to MTNL. The stock is up about 1 percent at Rs 13.9 a share.

Investment by households is also a significant contribution to the capex cycle. That part of the capex cycle has got a stimulus in this Budget, says Vetri Subramaniam of UTI AMC

The Budget has proposed new expenditures pressuring fiscal consolidation efforts, according to Moody’s

Moody’s believes continued slippage on fiscal deficit is credit negative for the Sovereign.

.

An analysis on how the Budget impacted the auto sector by Nitin Agrawal, senior analyst at Moneycontrol

Auto share are spiking today on the back of the announcement of the tax benefits to middle class taxpayers that would lead to an increase in disposable income and hence discretionary consumption.

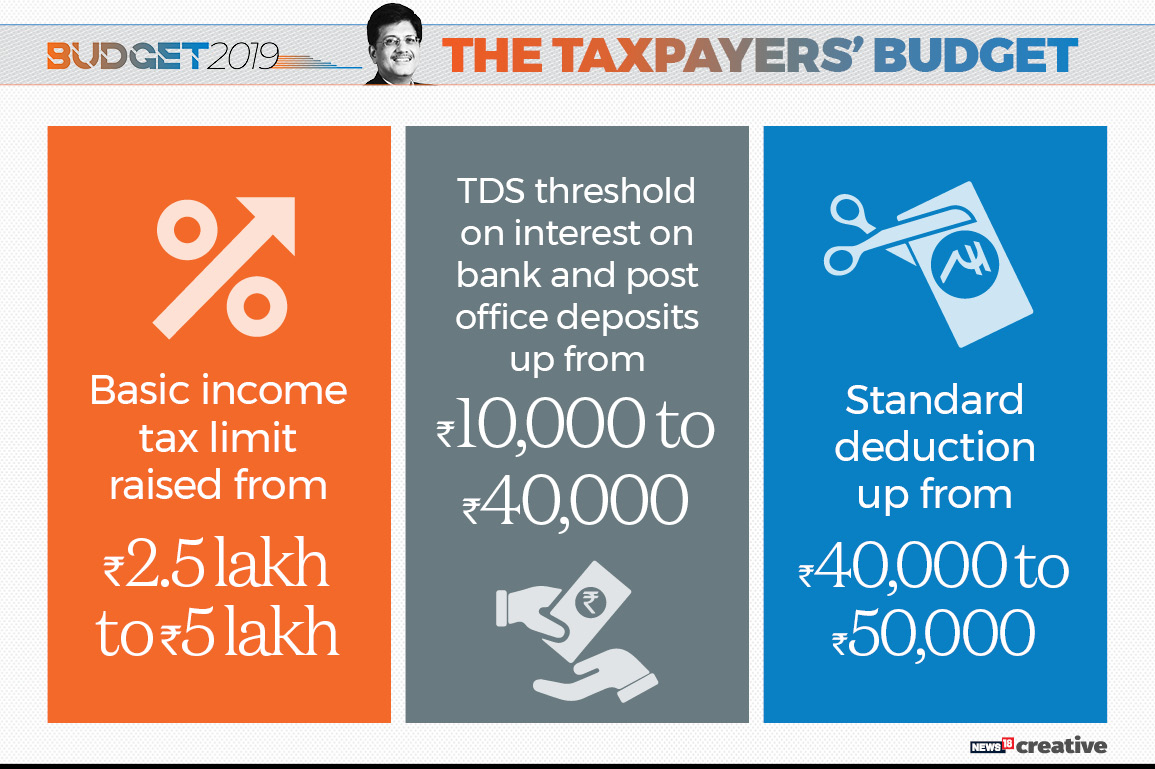

Here’s a quick review of the income tax relief announced by FM Goyal to clear any confusions over whether it was an exemption or rebate

The rebate under Section 87A of the Income Tax Act has been enhanced to Rs 12,500 from Rs 2,500 earlier. The threshold has also been enhanced to income of Rs 5 lakh from Rs 3.5 lakh earlier. This will benefit taxpayers only to the extent of an annual income of Rs 5 lakh. The basic exemption limit and tax-slabs remain the same.

What this means is the benefit is applicable only to those whose earnings are under Rs 5 lakh but not more than that. Also, those earning less than Rs 5 lakh will have to pay tax initially and seek a rebate while filing their returns.

| BE HEALTHY | BEST PRODUCTS FOR BEST LIFE

BE HOT |

BE SMART |

There has been a lot of confusion on the income tax measures announced. Moneycontrol’s review of the Finance Bill suggest

DEA Secy Garg said the roll-out of farm income support scheme starts in November. He pointed out that this scheme does not include those getting government support.

Measures for the salaried class will be effective April 1, Subhash Chandra Garg, Economic Affairs Secretary told CNBC-TV18.

The revenue loss from the change in income taxes will be roughly Rs 24,000 crore, he said.

Budget is unquestionably pro-growth and fiscally prudent, says Union Minister Arun Jaitley

In terms of new highs the market is making and the improving breadth I won’t be surprised if we tested new highs before general elections, Ramesh Damani tells CNBC-TV18

Consumption to GDP ratio in India is extremely low and taxes had slowed down consumption. The tax moves announced today will be significant in reviving consumption, says HDFC’s Deepak Parekh

Sensex gives a 300-point salute to the raft of announcements, as the market expects an uptick in consumption. Will the Budget be enough to put this market in firm bull market territory? Time will tell. – Nazim Khan, Senior Editor.

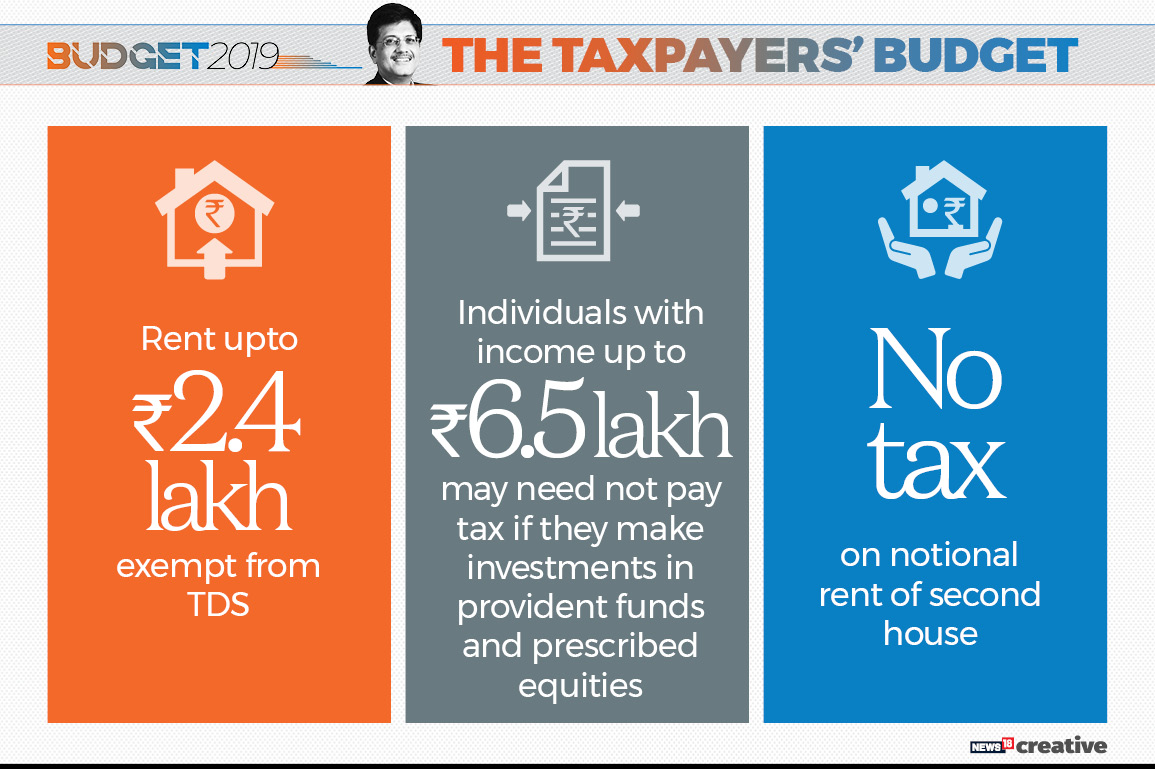

Notional rent on unsold real estate inventory – Tax to be levied after 2 years from date of completion of project. Previously, it was 1 year. Real estate stocks such as Oberoi Realty, Godrej Properties, Sunteck Realty, HUDCO rally. – Krishna Karwa, Research Analyst.

Goyal concludes his Budget speech with the quote, ” Ek paav rakhta hun, hazaar raahein phoot padti hai.” which literally means one step opens up a thousand roads.

Also, this Budget shows NDA’s desperation. This probably the best way to gain back trust of the voters. Or, if the coin flips (by chance), the next Government will have a really tough time to live up to all the promises the Modi Govt is making right now. – Sounak Mitra – Associate Editor.

Arun Jaitley might be missing all the fun while Piyush Goyal is cutting the cake that he (Jaitley) baked. – Sounak Mitra – Associate Editor.

This is not just a budget but lays out the path to progress of the country, he says

TDS limit hiked from Rs 10,000 to Rs 40,000 on Post-Office savings.

No tax on notional rent on second self-occupied house and no tds on house rent up to Rs 2.4 lakh

FM raises standard deduction from Rs 40,000 to Rs 50,000.

All interest income above Rs 40,000 from bank deposits will now get taxed and not Rs 10,000

Income upto Rs 5,00,000 to be exempt from income tax, to boost consumer spending. Positive for FMCG stocks and auto stocks. – Ruchi Agrawal – Senior Research Analyst.

Standard deduction has also been raised to Rs 50,000 from Rs 40,000

So those with income up to Rs 5 lakh and another Rs 1.5 lakh in investments totalling Rs 6.5 lakh will have to pay no tax. Will benefit nearly Rs 3 crore middle class income earners

Piyush Goyal serves the whole thaali….and keeps the dessert for the end…….#TaxRebate….. – Viju Cherian – Opinion Editor

That puts Rs 12,500 per annum in people’s pockets—more than Rs 1,000 per month, more than double what the farm package gives to small and marginal farmers. – Manas Chakravarty, Group Consulting Editor.

It finally comes. From ‘Thank you tax payers’, to doubling the slab for tax rebate. Now, tax payers would say: “Thank you Mr FM”. – Sounak Mitra – Associate Editor.

Govt announces tax exemption for income up to Rs 5 lk/yr: FM

The shortest interim Budget was given by HM Patel in 1977. This could be the longest. – Prince Thomas, Corporate Bureau Chief.

Individual tax payers with taxable annual income up to Rs 5 lakh will get full tax rebate

Some benefits must therefore also be passed on the middle class tax payers. Keeping this in view I propose to reduce the tax burden on tax payers. The salary earners, pensioners and senior citizens should not wait to get clarity on their taxes, he said

Goyal thanks taxpayers for their contribution toward the well being of the society and providing basic amenities to the poor. “The tax you pay will provide healthcare to 50 crore brothers, sisters and children,” he says

Confident of reaching Rs 80,000 Cr divestment target: FM

Will focus on debt consolidation along with fiscal consolidation, says Goyal

Confident of reaching Rs 80,000 crore divestment target, says Goyal

From ‘what we have done’ Budget, it has suddenly turned into a ‘Dream Budget’ — all about dreams and wishes towards 2030. – Sounak Mitra – Associate Editor.

In Piyush Goyal’s Budget, there’s place for everybody — Kissan, Jawan, Gau mata, and even the traders. But, not the income-tax paying salaried class. Well, they don’t figure in the scheme and theme of Election. – Sounak Mitra – Associate Editor.

Expenditure target for FY20 is at Rs 27.84 lakh crore and FY20 fiscal deficit target is at 3.4%

Expenditure target for FY20 at Rs 27.84 lakh cr: FM Goyal.

FM sets FY20 Fiscal Deficit target at 3.4%.

Vision statement: As Keynes said, in the long run we are all dead – Manas Chakravarty, Group Consulting Editor.

See India as a modern, technology-driven, high growth and transparent society as part of Vision 2030

Micro irrigation schemes to be given attention – allocation amounts awaited – allocations to be positive for Jain irrigation, KSB pumps, Kirloskar brothers and Shakti pumps. – Ruchi Agrawal – Senior Research Analyst.

“India will lead the world in transport through electric vehicle (EV) and energy storage devices”, FM said.

Several international automotive companies like Suzuki, Nissan, Hyundai, Toyota, Renault are lining up multiple EV launches through direct imports as well as giving a boost to local manufacturing of EV. – Swaraj Baggonkar – Senior Assistant Editor.

Placing an Indian astronaut in space by 2022 is also a part of Vision 2030

Electric vehicles a key part of govt’s vision for 2030: FM

Fisheries stocks – Apex Frozen, Avanti Feeds, Waterbase have declined after initial surge on interest subvention announcement. Allocation amount for schemes awaited. – Anubhav Sahu – Principal Analyst.

Making India digital will also play the most important role in achieving the vision. Goyal says, adding the third dimension will be making India pollution free. Making renewables a major source of energy supply and promoting electric vehicles will help, he says

Aspire to become $10 Tn economy in next 8 years thereafter: Goyal

The government is laying out the vision for the most important dimensions for the next 10 years to make India a $10 trillion economy and enhance ease of living including development of roads, railways, seaports, health, among other things.

India poised to become $5 Tn economy in next 5 Years: FM

We are poised to become $5 trillion economy in the next 5 years, says Goyal

The plea by Hero Motocorp, Bajaj Auto and TVS Motors to bring two-wheelers under the 18% GST slab from 28% GST slab seems to have gone unheeded. – Swaraj Baggonkar – Senior Assistant Editor.

Despite high speculation, no changes in tax slabs and no investment incentives for salaried investors and tax payers. – Nayanika Chakraborty – Senior News Co-ordinator.

Our govt wants GST burden on homebuyers to reduce. So we have requested the GST Council to set up a group of ministers who will now work out how to reduce the burden on homebuyers.

Most items of daily use are now in the 0-5% slab making GST beneficial for the middle class

Reducing tax for the middle class has been a priority, he says.

Here is how production of various crops and pulses fared under Modi government

From the MSP of rice and wheat to the area under cultivation for pulses, see how the Modi government has influenced key agricultural indicators.

Unmanned system to be created for scrutiny of income tax returns.

He now talks about Direct and Indirect Tax reforms

99.54% returns have been accepted without any scrutiny: FM

All income tax returns to be processed within 24 hours and refunds to be issued simultaneously: FM

Direct tax collections from 6.38 lakh crore rupees in 2013-14 to almost 12 lakh crore rupees; tax base up from 3.79 crore to 6.85 crore: FM

Tax scrutiny will also now be done electronically and there will be no interaction between the tax authority and the taxpayer.

Simplification of direct tax system will benefit taxpayers; direct tax reduced and tax interface made simpler and faceless to make life easier; resulting in increase in tax collections and return filings: FM

Tax collections have increased significantly. The number of returns filed have also risen: FM

In the last 5 years under all categories of workers, minimum wages increased by 42% which is the highest ever : FM

Tax collections have increased significantly from Rs 6.38 lakh crore in FY14 to almost Rs 12 lakh crore in FY19 with nearly 80% growth in the number of taxpayers, Goyal notes

Single window clearance for shooting films for Indian filmmakers.

Single window clearance for filmmaking to be made available to Indian filmmakers, anit-camcording provision to be introduced to Cinematography Act to combat film privacy: FM

34 crore JanDhanYojana accounts opened in last five years; Aadhaar almost universally implemented; ensuring poor and middle class receive government benefits directly: FM

Allocation for Northeastern region proposed to be increased to Rs 58,166 crore in this year, a 21% rise over the previous year: Piyush Goyal

Railway capital expenditure goes up from Rs 53,060 crore in FY19 to Rs 64,586 crore in FY20 – positive for railway capex linked companies. – Madhuchanda Dey – Head Research.

Our government hopes to create 1 lakh digital villages in the next 5 years. Jan Dhan, Aadhaar mobile, and direct benefit transfer have been game changers, Goyal notes. Aadhaar is now near-universally implemented and helped ensure poor get the benefit of govt schemes directly in their bank accounts, he says.

Villages to be converted to digital villages. Target over the next 5 years is to create over 1 lakh digital villages

Allocation for North Eastern Region proposed to be increased to 58,166 crore in this year, a 21% rise over previous year: FM

2% interest subvention to farmers for animal husbandry : FM

Cost of data and voice calls in India is possibly the lowest in the world: FM.

The operating ratio of Railways is seen at 96.2% in FY19 and 95% in FY20, Goyal says

Indian Railways budget outlay Rs 1,48,658 crore.

Installed solar generation capacity in India increased by 10 times in the last 5 years.

Inland freight waterways have commenced from Kolkata to Varanasi. North-eastern states may also be connected in due course.

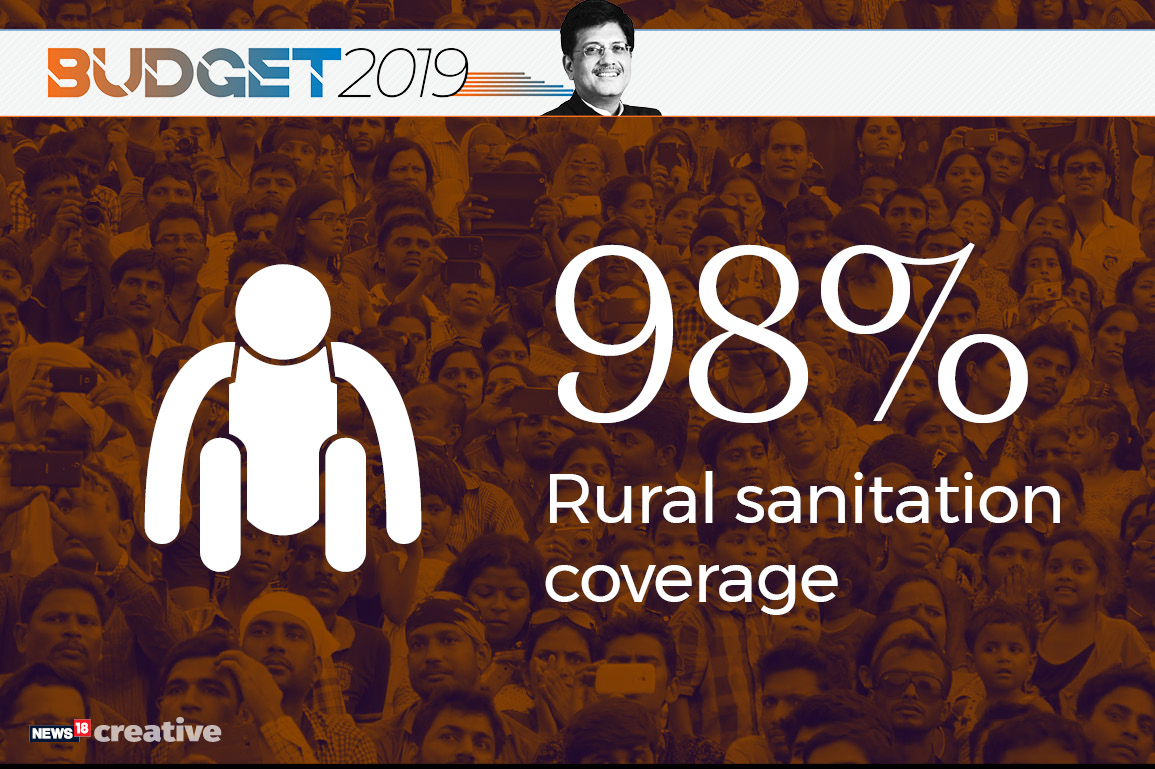

1. India has achieved over 98% rural sanitation coverage.

2. 5.45 lakh villages declared #ODF

3. #SwachhBharat now a national movement

Goyal talks about 100 plus airports now in India. But the number is far below the government target. – Prince Thomas, Corporate Bureau Chief.

India is the fastest highway developer in the whole world, 27 kms of highways built each day, projects stuck for decades completed; #SagarMala will help faster handling of import and export cars: FM

All farmers affected by severe natural disasters to will continue to get 2 per cent interest subvention and additional 3 percent on timely loan repayment: FM

Our soldiers are our pride and honour. OROP, pending for the last 40 years, has been implemented by us: Piyush Goyal.

Already disbursed Rs 35,000 crore for our soldiers under OROP, Substantial hike in military service pay has been announced.

Indian Railways has experienced the safest year in its history. All unmanned level crossings on broad guage network have been completely eliminated, Goyal highlights

Domestic air passenger traffic has doubled in the last 5 years.

Construction of rural roads has been tripled; 15.8 lakh out of a total 17.84 lakh habitations have been connected with pucca roads under #PMGSY.

#PMGSY allocated 19,000 crore rupees in 2019-20(BE) : FM

Bharat has got the full attention of the Govt. Farmers, cattle, unorganised segment, rural women, are among the major themes. But will these spur rural income? No disruptive intervention, yet. – Prince Thomas, Corporate Bureau Chief.

Defence Budget increased to Rs 3 lakh crore.

Domestic passenger traffic has doubled in the last 5 years and this will mean new jobs in the aviation sector.

Rs. 1 crore loan can now be obtained under 59 minutes: FM. Promises, and claims – Sounak Mitra – Associate Editor.

Over Rs 35,000 crore has been allocated under the ‘One Rank One Pension’ scheme so far by the BJP government.

Goyal allocates Rs 3 lakh crore for the defence sector for FY20. If necessary, additional funds will be provided for safety and security of our army personnel, Goyal says

Goyal now moves on the defence sector. We had promised to implement One Rank One Pension. We have already disbursed over Rs 35,000 crore after implementing the scheme in true spirit, he said.

India’s youth have turned into job creators from job seekers. The country has become the second-largest hub for startups: Piyush Goyal.

9 nine priority areas identified; National Artificial Intelligence Portal to be developed soon: Piyush Goyal.

To ensure cleaner fuel and health assurance, we embarked on PM Ujjwala Yojana, a programme to give 8 crore free LPG connections to rural households, out of which 6 crore connections have been given already: FM Piyush Goyal

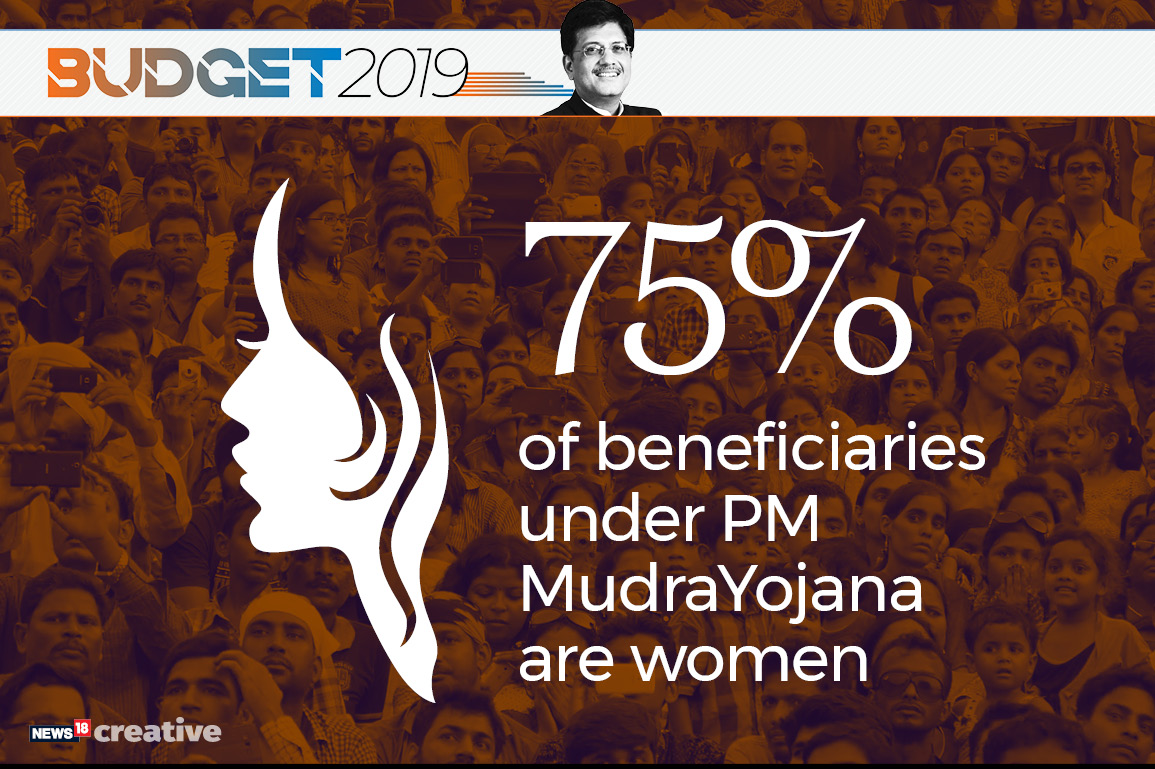

75% of woman beneficiaries under PM MudraYojana, 26 weeks of maternity leave and Pradhan Mantri Matritva Yojana, are all empowering women: FM

Goyal now throws in the term artificial intelligence. More power to Digital India. – Nazim Khan, Senior Editor

Pension scheme to benefit 10 crore workers in the unorganised sector. Those who join at 18 years of age will have to contribute a mere Rs 55 per month. The government will contribute equal matching share in the pension account.

Govt e-marketplace GEM has transformed public procurement making it transparent and efficient. Transactions of over Rs 17,000 crore has been done.

Have so far given loans worth Rs 7.23 lakh crore under the Mudra yojana with more than 70% of beneficiaries being women

Committee under NITIAayog to be set up to identify and denotify nomadic and semi-nomadic communities; Welfare Development Board to be set up under MSJEGOI for welfare of these hard-to-reach communities and for tailored strategic interventions : FM.

Workers who receive grievous injuries will now get Rs 6 lakh from Rs 2.5 lakh through EPFO: Piyush Goyal

There are a total of 42 crore workers in the unorganised sector in numerous industries. We must provide comprehensive social security coverage: Piyush Goyal.

6 crore households have been given cooking gas connections so far, the target by the end of next year is 8 crore households.

You have to give it to this government. While they sometimes fall to the temptation of naming new schemes after past leaders, many of their new schemes carry a simple convention — they carry the the term “Pradhan Mantri”. – Nazim Khan, Senior Editor.

FM Goyal moves on the welfare of women in the country. Nearly 8 crore free LPG connections were planned to be provided to relieve women from use of woodfire for cooking. So far 6 crore connections have already been provided.

Welfare department board to be set up under the Ministry of Social Justice and Empowerment.

50% of the GDP comes from the sweat and toil of 42 crore workers in the unorganized sector: Piyush Goyal.

For workers and labourers, a new pension scheme will come up to ensure an increase in Centre’s contribution by four percent. The pension has been increased from Rs 3,500 to Rs 7,000: FM Piyush Goyal.

A bevy of new scheme launches announced — shall we settle the debate, then? This is no “Interim Budget”. – Nazim Khan, Senior Editor

Instead of rescheduling of crop loans, those farmers severely affected by natural calamities will get 2% interest subvention and additional 3% interest subvention upon timely repayment: Piyush Goyal.

10 crore workers to benefit.

Goyal announced allocation of Rs 500 crore for mega pension scheme

Mega Pension scheme for the unorganised sector will see equal contribution from the government. Pension of Rs 3,000 to be paid out after retirement age

Monthly pension of Rs 3,000 for workers in unorganised sector.

Gratuity payment limit has been increased from Rs 10 lakh to Rs 20 lakh: FM

Nearly 42 crore workers in the unorganised sector contribute significantly to our economy. We must provide them a comprehensive social security coverage. So other than Ayushman Bharat, our govt proposes set up of Shram Yogi Mandhan, a pension scheme for unorganised sector workers

2% interest subvention to farmers pursuing animal husbandry and fisheries: FM

Govt will set up *Rashtriya Kamdhenu Aayog* to look after the welfare of cows, including genetic improvements and sustainable development. ” Yeh sarkar kabhi Gau mata ke samman mein peeche nahi hategi. (This government will never shy away from honoring our Mother Cow)

New Pension Scheme – employee’s contribution is 10%, government’s contribution increased from 10% to 14%.

ESI eligibility cover limit has been raised to Rs 21,000 per month from Rs 15,000 per month

Vix now down 5%. Market relaxed about the farm package – Manas Chakravarty – Group Consulting Editor.

Farmers struck by natural calamities will now get 2-5% interest subvention under the crop insurance scheme, Goyal said.

12.5 crore farmers to be covered under direct income support – PM Kissan. Annual cash benefit of Rs 6000 (to be paid in three tranches) per head. The total outlay is only 0.4% of GDP. This will not lead to big surge in agri input demand but will only benefit basic staples consumption. – Madhuchanda Dey – Head Research.

FMCG stocks rally with the farmer support announcements.

Marico, HUL, ITC up 1-2%.

2 percent interest subsidy to be given to farmers involved in animal husbandry activities, to be given through kisaan credit card scheme, additional 3 percent subsidy on timely payment of loans.

Stock of Mahindra & Mahindra, the market leader in tractors, is up nearly 2% on the BSE while that of Hero Motocorp the market leader in two-wheelers, stock is up by 3.35%.

Separate Dept of Fisheries to be formed.

The prices of medicines have come down with control of drugs, stents and knee implant prices.

India is the second largest fish producing nation in the world and provides livelihood to 1.45 crore people. Towards development of this sector the govt will create a separate department of fisheries. Propose 2% interest subvention for those in fisheries.

Rural FMCG demand has anyway been robust in FY19. The direct income support should add to this growth, for mass consumption items – Ravi Krishnan, Deputy Executive Editor.

Piyush Goyal, finance minister said, “There is a need a structured income support to the poor land holder to procure seeds, equipments and other needs. To support them we have formed PM KISAN. Under this the vulnerable farmers, upto 2 hectares will get direct income support of Rs 6,000 per year. The amount will be transferred directly into bank accounts of the farmer in three installments. About 12 crore farmers will benefit from it. The scheme will kick off from December 1”.

This is a positive for tractor and two wheeler sales – Swaraj Baggonkar – Senior Assistant Editor

Health cards, quality seeds, irrigation facilities etc have been taken into consideration to improve the well being of farmers, he noted.

PM Kisaan Samman Nidhi to support farmers in procuring basic farm inputs like seeds and fertiliser, to benefit seed and fertiliser companies.

This will cost the govt around Rs 75,000 crore.

Direct Benefit Support of Rs 6,000 to farmers with landholdings below 2 hectares – to be transferred directly into bank account of beneficiary farmers in three installments of Rs 2,000 each, funded by Govt of India – around 12 crore farmers to benefit from the scheme.

The Kisan yojana will be effective December 1, 2018, and the money will be directly transferred into their account. Expect spend of Rs 75,000 crore on this scheme, says Goyal. Rs 20,000 crore allocation will be added to the revised estimates of the FY18-19, he said.

Govt approves PM Kisaan Samman Nidhi.

Farmers owning upto 2 hectares to get Rs 6,000 per year.

Ayushman Bharat, the world’s largest healthcare programme, was launched to provide medical care to nearly 50 crore people, resulting in Rs 3,000 crore savings by poor families: Piyush Goyal.

One million people were treated so far under Ayushman Bharat. Have announced 14 new AIIMS since 2014.

In 2014, 2.5 crore families were living without electricity, forced to live in the 18th century. We have achieved almost 100% electrification, says Goyal.

Farmers with less than 2 hectare land will be given Rs 6,000 per year as direct transfer

Keeping in view the distress in farm sector, we revised MSP in favour of our hardworking farmers. Small and fragmented land holding has led to decline in farm income. To provide support to small and marginal farmers and improve their income the Pradhan Mantri Kisan Samman Nidhi yojana has been introduced

As a tribute to Mahatma Gandhi, the world’s largest behavioural change movement Swachh Bharat was initiated; more than 98% rural sanitation coverage has been achieved, says Piyush Goyal.

Rs 1,70,000 crore spent on bringing food at affordable rates to poor people: FM

We are happy to announce that the 22nd AIIMS hospital is going to be set up in Haryana, Goyal said highlighting lower prices in terms of medicines, stents etc have led to massive scale up in healthcare over the last 5 years.

PMGSY allocation Rs 19,000 crore, same as budgeted for 2018-19.

20 minutes into the speech, the Budget continues like a campaign pitch for the government.

We launched the world’s largest healthcare program Ayushman Bharat to provide medical treatment to nearly 50 cr people, he reiterates. So far 10 lakh people have been treated under this scheme within the short span and nearly Rs 3,000 crore has been saved by those covered under it.

Mahatma Gandhi National Rural Employment Guarantee program’s allocation increased by Rs 5000 crore to Rs 60,000 crore, Madhuchanda Dey – Head Research, Moneycontrol.

The government is committed to providing electricity to every house. LED will help save Rs 50,000 crore in electricity bills in the next few years.

Auto stocks firm, market appears to be betting on a likely farm package boosting demand for automobiles.

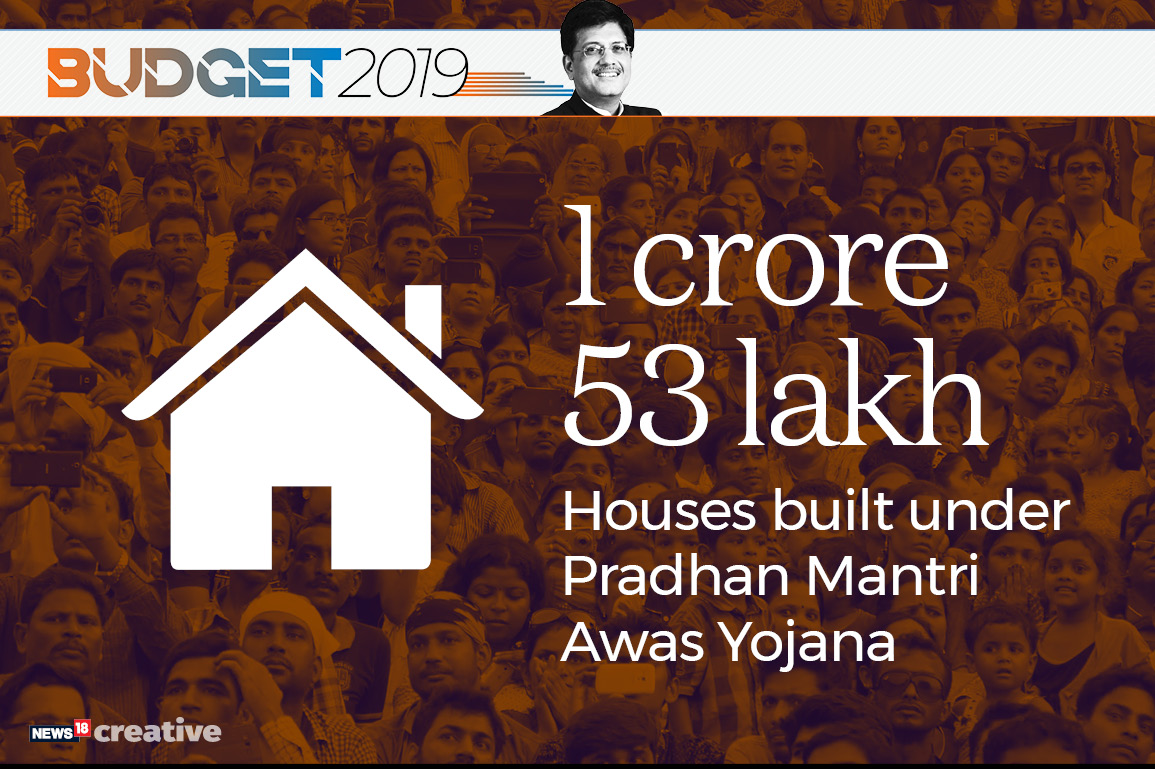

One crore 53 lakh houses have been made which is 5 times the earlier run rate

Pradhan Mantra Gram Sadak Yojana allocation is set at Rs 19,000 crore, he said, adding, kids will no longer have to walk from home to school. They will now have a bus service there.

MGNREGA allocation has been set at Rs 60,000 crore for FY19-20, Goyal says

Election speech on in full swing.

Rs 3 lakh crore recovered by banks through IBC, says Goyal. Now bigger businessmen also concerned about repaying debt, he adds.

Have recovered Rs 3 lakh crore so far from the banking system clean up, Goyal points out as he moves to the initiatives in the real estate sector.

RERA 2016 and Benami Transaction Prohibition Act are helping to bring transparency in real estate, he said

Goyal takes dig at UPA government, by saying that his government has ended the practice of ‘phone’ banking at state-owned banks, and ushered more transparency.

“The Rs 1 trillion GST collection in January would have given some comfort. Still Rs 2.8 trillion needed in the next two months to achieve budgeted estimates.” – Ravi Krishnan – Deputy Executive Editor, Moneycontrol.

We have noticed that Bank of India, Bank of Maharashtra and Oriental Bank have come out of the PCA framework and our efforts to clean up the banking system will help others too very soon, Goyal says

Earlier there was pressure on only small businessmen to repay loans but now even defaulting managements of big companies are under pressure to repay loans in time

Our govt had the power to ask RBI to review the NPA situation of banks and stop the culture of phone banking, says Goyal

Current account deficit target for FY19 – 2.5% of GDP.

Fiscal deficit revised target for FY19 – 3.4%.

So, that’s a miss on the fiscal deficit target of 3.3% this year. Even this should be taken with a pinch of salt given the possibility of off-balance sheet items.

He’s proud of restoring fiscal balance. Does that mean he will stick to the target?

Piyush Goyal’s remark that farmer incomes have doubled, greeted with boos from the opposition benches.

Goyal starts with recounting a litany of achievements for the Modi government. Reads like a poll pitch so far.

2018-19 revised fiscal deficit target at 3.4%, Goyal points out

If we had not controlled inflation, our families would have been spending 35-40% more on basic amenities today, says Goyal

We brought down average inflation to 4.6% lower than inflation during tenure of any other govt, he says.

“We have reversed the policy paralysis,” says Piyush Goyal as he rises to present the Interim Budget, “India is solidly back on track.”

One thing hasn’t changed. The Budget Speech starts with a din

There is hope the government will also focus on pushing the sales of electric vehicles in the country. The finance ministry on Tuesday had lowered customs duty on electric vehicle parts to 10-15% from 15-30%. Society of Indian Automobile Manufacturers (SIAM) welcomed the move.

1 hour ago

Union Minister Piyush Goyal presents the Budget 2019 in the Lok Sabha.

| BE HEALTHY | BEST PRODUCTS FOR BEST LIFE

BE HOT |

BE SMART |

Disclaimer: RSS has been taken from their official website.